Trump Redux shadows Xi-Biden at APEC

Josef Mahoney on likely encounter between Xi and Biden at up coming #apec and #g20. Transactional Trump effect on US-China ties, Huang Yiping on Trade war redux under Trump & China’s stimulus U-turn

APEC and G20 in the New Era

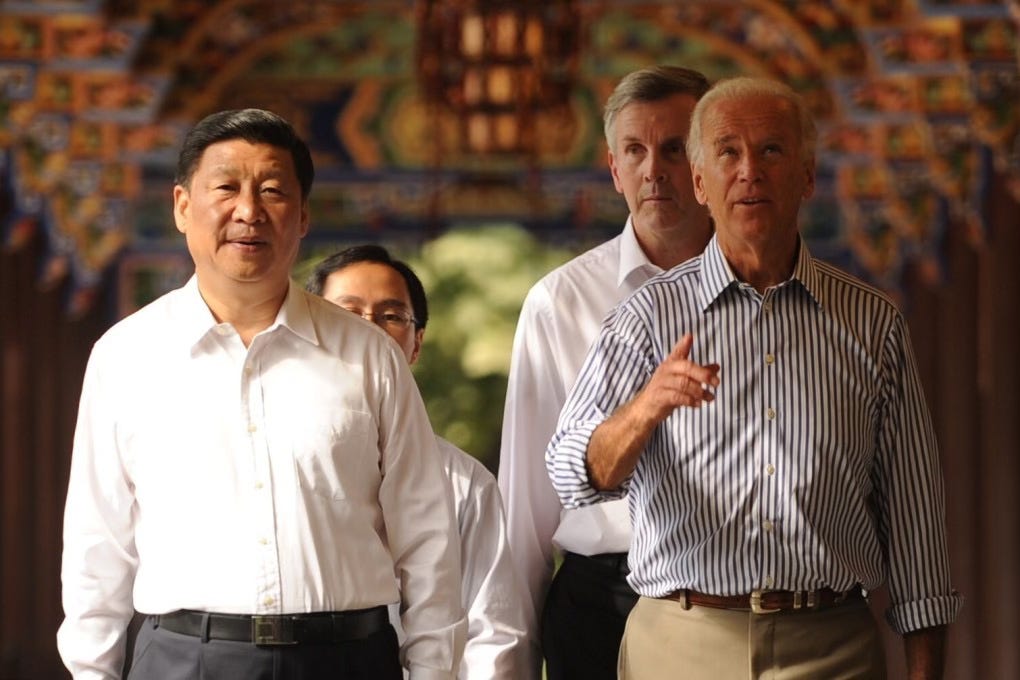

Featured contributor Prof. Josef Mahoney was interviewed by Ziwen Zhao for his article South China MorningPost #scmp on the the likely encounter between Xi and Biden at the up coming #apec and #g20 meetings in #lima, on their potential for dissuading possible black swan events or how they might be read by #trump.

Full remarks:

A meeting at this point risks Biden grandstanding, it risks irritatingTrump, and it wouldn't deter whatever last-minute negativity Sullivan orwhoever has cooked up as a coda to forthcoming memoir. lf Biden plansto implement a black swan event, say through #taiwan,

the #philippines or some other point of leverage, this kind of meeting isunlikely to deter him.

Furthermore, #china is not afraid of the U.S. Beiing has deployedadequate national defense measures to discourage and respond ifnecessary to a last-minute provocation. lt's not counting on some highrisk personal diplomacy to thwart such potential dangers

Beijing understands that sending messages through Biden to Trumpwould be off putting to all three men: Xi, Biden and Trump. Further,Trump has repeatedly asserted he has a personal relationship with Xithat Xi even sent him well-wishes following the failed assassinationattempt.

Meanwhile, the Biden Administration has been systematically trying to"Trump proof" its foreign policy for several months, efforts that alreadywere underway when Jake Sullivan last visited Beijing

Nevertheless, it's not impossible to imagine a cordial but brief exchangeif Biden is interested, because #beiiing is surely happy to say goodbye tchim once and for all.

If China's Xi and 'lame duck’ Us leader Biden hold talks, will Trump listen?

https://www.scmp.com/news/china/diplomacy/article/3285832/can-another-xi-biden-summit-sway-us-china-ties-under-trump-20

Transactional Trump effect on US-China ties

The new US president is likely to negotiate a second-phase trade deal, seek China’s help to end wars, and keep the Taiwan status quo.

Although Donald Trump’s return as president of the United States brings greater uncertainty, his transactional and pragmatic approach may also provide new possibilities for cooperation and stabilising relations with China. For a start, the president-elect is likely to open new trade and investment negotiations with China.

True, during Trump’s first term from 2017-2021, significant changes took place in the US’ economic and trade relationship with China. In 2017, for the first time, the US national security strategy report positioned China as a strategic rival. Months later, the Trump administration started to slap tariffs on Chinese imports, escalating the trade friction into a trade war. During his election campaign, he also said he was consideringtariffs of 10-20 per cent on all imports and 60 per cent or higher on Chinese goods.

But Trump, whose administration negotiated the first phase of the Sino-US trade agreement, may also continue to push for Sino-US economic and trade deals in his second term, including on investment. He may well direct his incoming administration to open new negotiations with China on subsidy policies, overcapacity issues and trade imbalances. He could conduct second- or third-phase trade deal negotiations based on the first.

Also, Trump holds a relatively open attitude towards Chinese business investment in the US and may encourage or require them to invest and set up factories. Fuyao Glass, for instance, has set up factories and taken root in the US while Contemporary Amperex Technology Limited (CATL) is in discussions with American companies about investing in the US.

Trump has close ties with the business community, including many Fortune 500 companies such as Tesla, Blackstone and Apple. These companies have long-term investments in China and this may prompt some rationality in the new Trump administration, which might even lift some limits on Chinese-owned companies such as TikTok, and sanctions on individuals.

Trump will also need to seek Chinese support to resolve the wars he has promised to. Positioning himself as the president for peace, he has claimed he can end the Russia-Ukraine war before his inauguration, even within 24 hours, and threatened to cut military aid to Ukraine if need be. He also reportedly told Israel to end its war before his presidency starts next January.

https://www.scmp.com/opinion/world-opinion/article/3285621/transactional-trump-may-well-improve-us-china-ties

Huang Yiping on trade war redux under Trump and China’s stimulus ‘U-turn’

Huang Yiping of Peking University talks the re-election of Donald Trump as and why China needs its own Marshall Plan.

Huang Yiping is dean of the National School of Development at Peking University and sits on the Monetary Policy Committee of the People’s Bank of China and the Hong Kong stock exchange’s Mainland China Advisory Group. Previously, Huang was a senior economist with Barclays and Citigroup in Hong Kong.

In this interview, Huang discusses trade prospects during a second Donald Trump administration and the details of his idea for a “Chinese Marshall Plan”. For other interviews in the Open Questions series, click here.

On Friday, China’s top legislative body announced an additional 6 trillion yuan(US$838.1 billion) in hidden debt relief for local authorities, with more support pledged for next year. How helpful is this? With Donald Trump set to return to power, should Beijing roll out more stimulus?

The debt swap plan can take some immediate pressure off a lot of local governments, and thus lessen their “contraction effects” when it comes to putting Beijing’s stimulus into place.

The “contraction effects” stem from the fact that many financially strapped localities cannot effectively implement pro-growth measures, and their inability to do more due to tight finances is diluting Beijing’s growth push.

My advice is the central government raise its deficit ratio, to bear more debts in next year’s budget and expand the incomes of local authorities.

Donald Trump is very likely to further hike tariffs to target China. Beijing should take precautions by rolling out more measures to stabilise and spur domestic demand.